Experience a seamless end-to-end solution by harnessing Al technology to merge title search and title insurance processes. Our advanced algorithms ensure accuracy and completeness, delivering faster results with higher quality. Say goodbye to tedious paperwork and delays – embrace efficiency and ease with our integrated approach.

For less hassle and delay; we'll deliver your results in record time.

Mitigate potential issues quicker by using sophisticated data for both sellers and buyers.

Thanks to support from our team of commercial title insurance experts

Leveraging our exclusive technology and an extensive network of commercial search experts spanning the entire United States, we are equipped to fulfill commercial search projects in all U.S. counties. Simply request the size or type of title search report you need within a workflow that suits your preferences, and we will provide you with a meticulously crafted, commitment-ready report.

Don’t see exactly what you need below? Contact us.

Our advanced Al technology examines public records to ensure the title to your property is pristine and clearly identifies potential risks to your purchase

Our national commercial title insurance policies offer expansive coverage. With us, you're not just buying insurance - you're securing peace of mind

Based on the results of the title search, we will issue a title insurance policy to protect you from potential risks to your purchase.

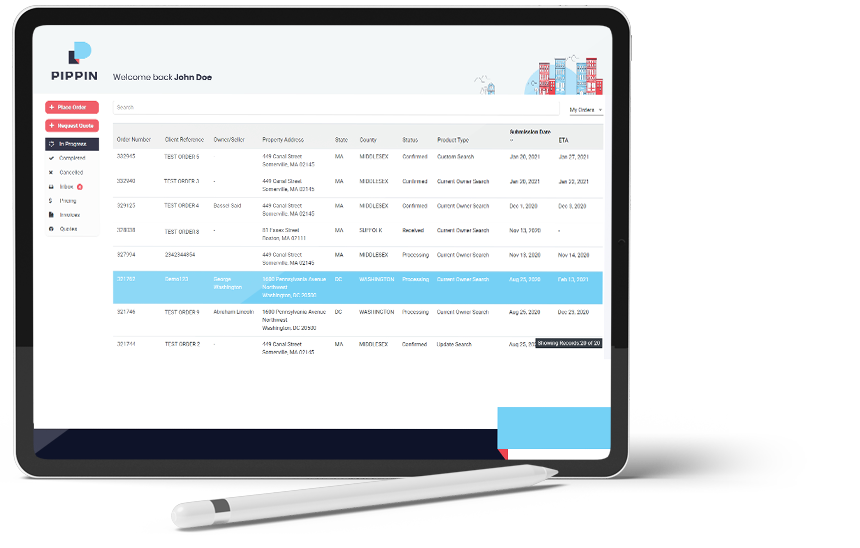

Stay organized with our title insurance portal. Access everything you need in one place such as progress update, customer support and much more.

Once the search is complete and any concerns are addressed, we craft a customized title insurance policy to shield you from future risks. This policy provides robust protection against a wide array of potential challenges, giving you confidence in your investment.

that integrate seamlessly with your existing workflows for simplified ordering, tracking and invoicing.

Forget chasing after ground searchers and poring over documents. With our proprietary search and insurance technology, reliable searcher network, and rigorous quality control, you get accurate, commitment-ready exports every time – fast.

Why should you choose Pippin Title? It’s a great question. We utilize advanced technology to standardize and automate the title search process. This means that in just a couple of clicks, you can have both the title search and title insurance completed in record time. Let technology handle all the hard work, eliminating human error and delivering your reports faster than ever before. The more complex the problem, the easier it is for us to solve.

that integrates seamlessly with your existing workflows for simplified ordering, tracking and invoicing.

That are backed by our rigorous quality control process.

Our transparent premium structure ensures you know exactly what you're paying for with no hidden fees.

In the unlikely event of a covered title issue, our streamlined claims process ensures prompt resolution.

Get standardized reports, complete with a summary cover page and indexed documents, for every commercial search. Quit the endless scrolling and handwritten notes and get real information that can be reviewed in minutes, not hours.

Know the status of every file, no phone tag required. Our real-time order tracker shows you your ETA and exactly what’s going on with your search & insurance at a click, so you’re never again waiting in the dark.

Title insurance acts as protection against potential issues with the ownership title when purchasing real estate. It shields buyers from pre-existing problems such as unpaid property taxes, fraudulent paperwork, or claims from undisclosed spouses or heirs

When you obtain title insurance, you enter into a contractual agreement that shields you from financial losses stemming from defects in the property’s title. These defects could include liens, encumbrances, or other issues that weren’t apparent when the policy was issued.

A title insurance company provides indemnity insurance, safeguarding both lenders and homebuyers against financial losses related to defects in a property’s title. Operating independently from the lender, buyer, and seller, a title insurance company assists in securing the property’s rights as solely yours through the provisions of title insurance, title search, and settlement services.

Residential title insurance protects single-family homes, condos, and small multi-unit dwellings from title defects and disputes. Commercial title insurance, on the other hand, is tailored for larger properties like office buildings and retail centers, offering similar protection but with higher premiums due to increased complexity.

Yes, you can purchase title insurance after closing, but it’s not advisable as it leaves a gap in protection. While lenders often require it for loan approval, owner’s title insurance can be bought anytime after closing to protect against future issues with the property’s title.

Typically, the buyer pays for title insurance at closing, but this can vary depending on the terms of the sale agreement.

To purchase title insurance with Pippin Title, simply contact us directly, and our team will guide you through the process of acquiring the coverage you need.

The cost of title insurance for a commercial property can vary based on factors such as the property’s value, location, and the coverage amount needed. For an accurate quote, contact us for a consultation.

Title insurance premiums are typically based on the property’s purchase price or its insured value. Other factors such as the location and type of property may also affect the premium. For precise calculations, consult with our team.

575 5th Avenue, Suite 500

New York, NY 10017

Need help with your search? A representative is ready and willing to help.

Kept abreast of Pippin Title software and service improvements, as well as helpful tips and tricks.

Want to get involved and be part of the Pippin team? We are always looking for talent.

© 2025 Pippin Title.